After completing this course, you will be able to:

The CLEA framework applies to Citi employees who engage, or may engage, in Cross Legal Entity Activity onto the relevant Inbound Legal Entity, or who have responsibility for the oversight and monitoring of Cross Legal Entity Activity in Markets and Personal Banking and Wealth Management - CitiMortgage Inc (PBWM CMI). Select here for a definition of Cross Legal Entity Activity and various terms relating to CLEA.

The CLEA framework applies to the following legal entities:

| NAM | LATAM | EMEA | APAC (excl. Japan) | Japan |

|---|---|---|---|---|

US:

|

Mexico:

|

UK:

|

Singapore:

|

Japan:

|

Ireland:

|

Hong Kong:

|

|||

Germany:

|

||||

Europe: Citibank Europe (CE5):

|

||||

| For information on your specific Senior Manager, contact the relevant business line CAO. | ||||

Next, let’s consider the CLEA responsibilities of the second line of defense and enterprise support functions.

Select each role to learn more.

Chief Risk Officers (or equivalent functions in the applicable legal entity) oversee and review, in collaboration with the relevant Businesses, the risk introduced to the balance sheets of relevant Inbound Legal Entities through Cross Legal Entity Activity.

ICRM assists in assessment and classification of Unauthorized Transactors and allocating severity ratings. ICRM performs appropriate review and challenge in forums and committees as required by the Global Conduct Risk Management Policy.

HR will consider any reported unauthorized Cross Legal Entity Activity for potential disciplinary action, assess severity, report the results back to the Business and consider the activity as part of year-end performance review for Transactors.

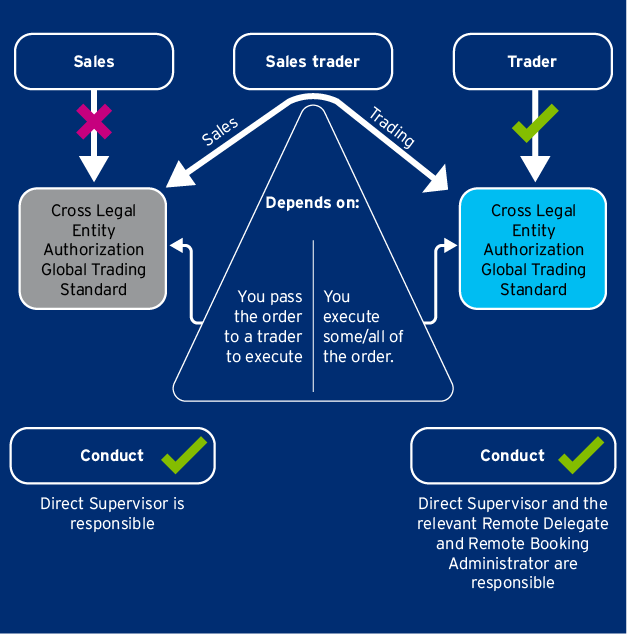

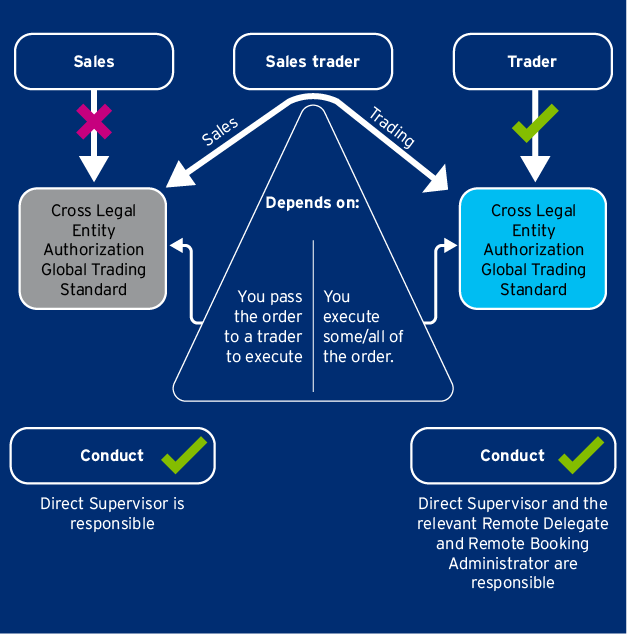

If you are booking on to a Legal Entity that you are not employed by, then whether the CLEA Standard is relevant or not depends on who executes the order. If you execute some or all the the order yourself, then the CLEA Global Trading Standard applies, as the diagram shows.

Any material conduct related matters must be escalated to your Direct Supervisor, relevant Remote Delegate and Legal Entity Representative. Transactors must not book onto an Inbound Legal Entity until they are authorized.

Diagram showing that if a sales trader passes the order to a trader to execute, the CLEA Standard does not apply and their Direct Supervisor is responsible. If they execute some or all of the order, the CLEA Standard applies and the Direct Supervisor, Remote Delegate and remote Booking Administrator are responsible.

Which role provides sign-off for a Transactor’s CLEA request?

Select the best response and then select Submit.

Not quite.

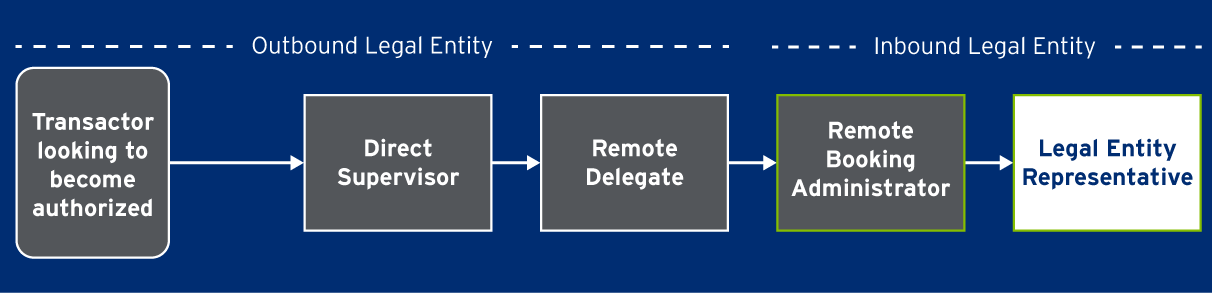

The Remote Delegate must sign off the Transactor’s CLEA request. The Direct Supervisor must review and verify the request. The RBA provides approval on behalf of the inbound entity’s Business for the Cross Legal Entity Activity proposed and the LER has ultimate responsibility for approving and authorizing any Transactors wishing to engage in Cross Legal Entity Activity with the inbound entity.

That’s right.

The Remote Delegate must sign off the Transactor’s CLEA request. The Direct Supervisor must review and verify the request. The RBA provides approval on behalf of the inbound entity’s Business for the Cross Legal Entity Activity proposed and the LER has ultimate responsibility for approving and authorizing any Transactors wishing to engage in Cross Legal Entity Activity with the inbound entity.

Not quite.

The Remote Delegate must sign off the Transactor’s CLEA request. The Direct Supervisor must review and verify the request. The RBA provides approval on behalf of the inbound entity’s Business for the Cross Legal Entity Activity proposed and the LER has ultimate responsibility for approving and authorizing any Transactors wishing to engage in Cross Legal Entity Activity with the inbound entity.

Not quite.

The Remote Delegate must sign off the Transactor’s CLEA request. The Direct Supervisor must review and verify the request. The RBA provides approval on behalf of the inbound entity’s Business for the Cross Legal Entity Activity proposed and the LER has ultimate responsibility for approving and authorizing any Transactors wishing to engage in Cross Legal Entity Activity with the inbound entity.

Each Transaction Authorization Request (TAR) must specify one of the following justifications to engage in Cross Legal Entity Activity on a specified Inbound Legal Entity:

The TAR will undergo an authorization process before a Transactor becomes approved to engage in Cross Legal Entity Activity on to the relevant Inbound Legal Entity.

Select the number below each stage in the process to see what’s expected of each role.

Required input from the Transactor as part of the request:

Which of the following is the responsibility of the Direct Supervisor in the Cross Legal Entity Authorization process?

Select the best response and then select Submit.

That’s right.

The Direct Supervisor must review whether the authorization rationale is suitable and applicable. Both the Remote Delegate and LER must review the appropriateness of the rationale for using the relevant Inbound Legal Entity. The RBA is responsible for checking whether the RBAP has completed the required Cross Legal Entity Authorization training. The Transactor looking for authorization must provide an appropriate reason for the request detailing why a specific Inbound Legal Entity should be used.

Not quite.

The Direct Supervisor must review whether the authorization rationale is suitable and applicable. Both the Remote Delegate and LER must review the appropriateness of the rationale for using the relevant Inbound Legal Entity. The RBA is responsible for checking whether the RBAP has completed the required Cross Legal Entity Authorization training. The Transactor looking for authorization must provide an appropriate reason for the request detailing why a specific Inbound Legal Entity should be used.

Not quite.

The Direct Supervisor must review whether the authorization rationale is suitable and applicable. Both the Remote Delegate and LER must review the appropriateness of the rationale for using the relevant Inbound Legal Entity. The RBA is responsible for checking whether the RBAP has completed the required Cross Legal Entity Authorization training. The Transactor looking for authorization must provide an appropriate reason for the request detailing why a specific Inbound Legal Entity should be used..

Not quite.

The Direct Supervisor must review whether the authorization rationale is suitable and applicable. Both the Remote Delegate and LER must review the appropriateness of the rationale for using the relevant Inbound Legal Entity. The RBA is responsible for checking whether the RBAP has completed the required Cross Legal Entity Authorization training. The Transactor looking for authorization must provide an appropriate reason for the request detailing why a specific Inbound Legal Entity should be used.

The primary control to detect transactors operating outside their Individual Trader Mandate by booking without authorization to a legal entity is the T0 Legal Entity Alert. This automated control only applies to Markets. PBWM CMI relies on a manual, detective control executed by Trade Operations.

This reviews all transactions booked onto in-scope legal entities to ensure the Transactor is authorized in line with the relevant CLEA Authorization entity authorization list. If the person is not on the appropriate list, UNO will generate a T0 Legal Entity Alert.

Select each number on the image to learn more.

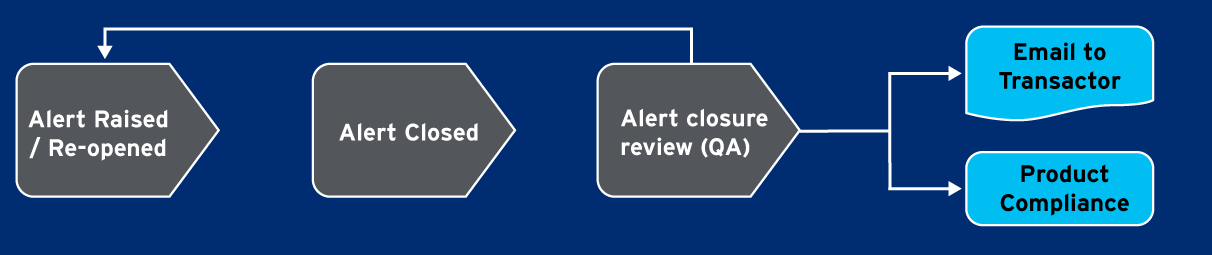

The alert is reviewed by the Business Management in the country for the product and assessed as either an Operational Violation or Unauthorized Activity.

Timeliness to close alerts is monitored via daily/weekly reporting. There is daily follow-up with Business Managers on all aging alerts.

All closed alerts are reviewed to ensure the correct reason codes have been applied. QA review may result in an alert bring re-opened.

If unauthorized trading activity has been identified, the transactor is advised by email (cc trading supervisor) to cease trading until fully authorized.

All unauthorized trading activity is escalated to Product Compliance for further review and action.

Think back to what you read earlier about needing a license to drive a car. There are different levels of penalties for not following the rules when driving, and there’s a risk you could lose your license.

What do you think would happen if you failed to follow the requirements for CLEA?

How is the timeliness to close UNO T0 alerts monitored?

Select the best response and then select Submit.

Not quite.

Timeliness to close alerts is monitored via the daily and weekly dashboards. There is daily follow-up with business managers on all aging alerts.

That’s right.

Timeliness to close alerts is monitored via the daily and weekly dashboards. There is daily follow-up with business managers on all aging alerts.

Not quite.

Timeliness to close alerts is monitored via the daily and weekly dashboards. There is daily follow-up with business managers on all aging alerts.

Not quite.

Timeliness to close alerts is monitored via the daily and weekly dashboards. There is daily follow-up with business managers on all aging alerts.

A number of European regulators have specific requirements regarding CLEA. The firm must take these requirements into account in developing systems and controls commensurate with the risks that it incurs across businesses and geographical locations. Without proper arrangements in place, the booking of transactions onto a UK/EU legal entity by employees of non-UK/EU legal entities may lead to significant legal, regulatory, tax and personal implications.

Select each tab to learn more.

The UK regulators (Financial Conduct Authority and Prudential Regulation Authority) have an expectation that all activity booked onto UK legal entities is overseen by an approved Senior Manager, regardless of the country from which it is booked.

Under rule SYSC 3.1.1 of the FCA Handbook:

“A firm must take reasonable care to establish and maintain such systems and controls as are appropriate to its business”, taking into account such factors as the “nature, scale and complexity of its business, the diversity of its operations, including geographical diversity, the volume and size of its transactions, and the degree of risk associated with each area of its operation”.

RBAPs on CGML, CBNA London branch and CEP UK must note the FCA requirements regarding the Client Asset Sourcebook (CASS).

You must select the link above before continuing.

According to the “Supervisory expectations on booking models” issued by the ECB in August 2018:

As an SSM entity, CEP must maintain a “sound and effective” risk management and governance framework through an appropriately skilled staff and governance body, and must be able to provide effective oversight over its activities and booking practices.

The German regulator, BaFin, has an expectation that all activity booked onto CGME is overseen by the CGME Head of Markets and Securities Services, regardless of the country from which it is booked.

A number of laws and regulations are relevant:

The Fitness and Probity (F&P) Standards are issued by the Central Bank of Ireland (CBI) pursuant to the powers set out in Irish law.

The Central Bank Reform Act of 2010 provides that a person performing a controlled function (CF) in regulated financial service providers must have a level of fitness and probity appropriate to the performance of that particular function.

The Citibank Europe Plc (CEP) MSS Head has determined that employees who have the ability to book transactions to CEP will be treated in the same manner as a proprietary transactor equivalent to the CF11 classification:

In this course, you’ve seen that there is significant internal and external focus on the risks associated with overseas booking onto Inbound Legal Entities. You should now understand:

It’s essential that you know:

Finally, remember that if you are ever unsure, escalate.

Haruto-san, a rates transactor based in Japan who currently books all risk on his local legal vehicle (CGMJ), is approached by one of his regular clients to start trading US swaps. Haruto-san would like to book this activity onto CBNA NY.

Which individual(s) must Haruto-san receive authorization from before booking onto CBNA NY from a cross legal entity transaction perspective?

Select the best response and then select Submit.

That’s correct.

That’s not correct.

For a better understanding, review topic 2, What Is CLEA? and topic 3, The CLEA Process.

That’s not correct.

For a better understanding, review topic 2, What Is CLEA? and topic 3, The CLEA Process.

That is correct.

That is not correct.

That is not correct.

Who has the ultimate responsibility for the cross legal entity activity booked onto an Inbound Legal Entity?

Select the best response and then select Submit.

That’s correct.

That’s not correct.

For a better understanding, review topic 2, What Is CLEA?

That’s not correct.

For a better understanding, review topic 2, What Is CLEA?

That is correct.

That is not correct.

That is not correct.

Which of the following roles is/are employed or located in the same country or region as the Inbound Legal Entity?

Select the best response and then select Submit.

That’s correct.

That’s not correct.

For a better understanding, review topic 2, What Is CLEA?

That’s not correct.

For a better understanding, review topic 2, What Is CLEA?

That is correct.

That is not correct.

That is not correct.

Who should the RBAP inform regarding any changes that impact the relevant Cross Legal Entity Authorization, including a change of the RBAP’s role and when they no longer expect to engage in Cross Legal Entity Activity onto a relevant Inbound Legal Entity?

Select the best response and then select Submit.

That’s correct.

That’s not correct.

For a better understanding, review topic 3, The CLEA Process.

That’s not correct.

For a better understanding, review topic 3, The CLEA Process.

That is correct.

That is not correct.

That is not correct.

Which of the following triggers a need to raise a Transactor Authorization Request (TAR) for a Transactor?

Select all that apply and then select Submit.

That’s correct.

That’s not correct.

For a better understanding, review topic 3, The CLEA Process.

That’s not correct.

For a better understanding, review topic 3, The CLEA Process.

That is correct.

That is not correct.

That is not correct.