That’s right.

All of these are examples of TPCR (Third Party Credit Risk).

Not quite.

All of these are examples of TPCR (Third Party Credit Risk).

Not quite.

All of these are examples of TPCR (Third Party Credit Risk).

Not quite. Please try again.

You have missed some options. Review and try again.

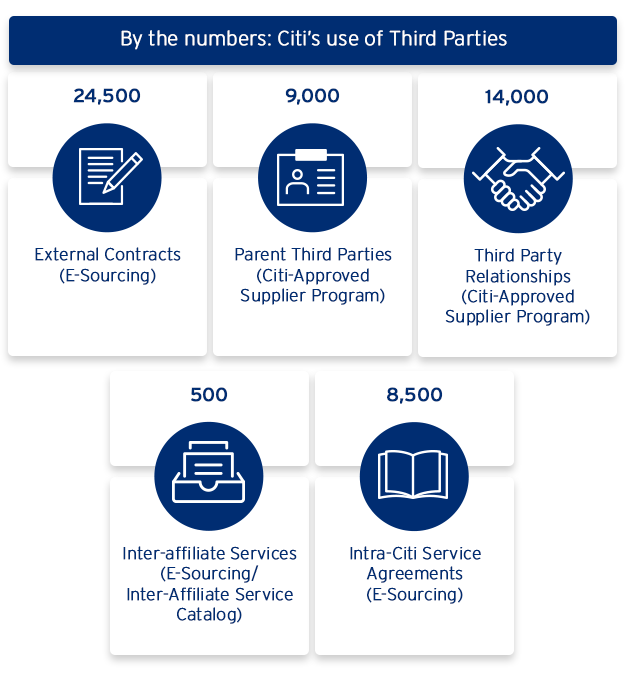

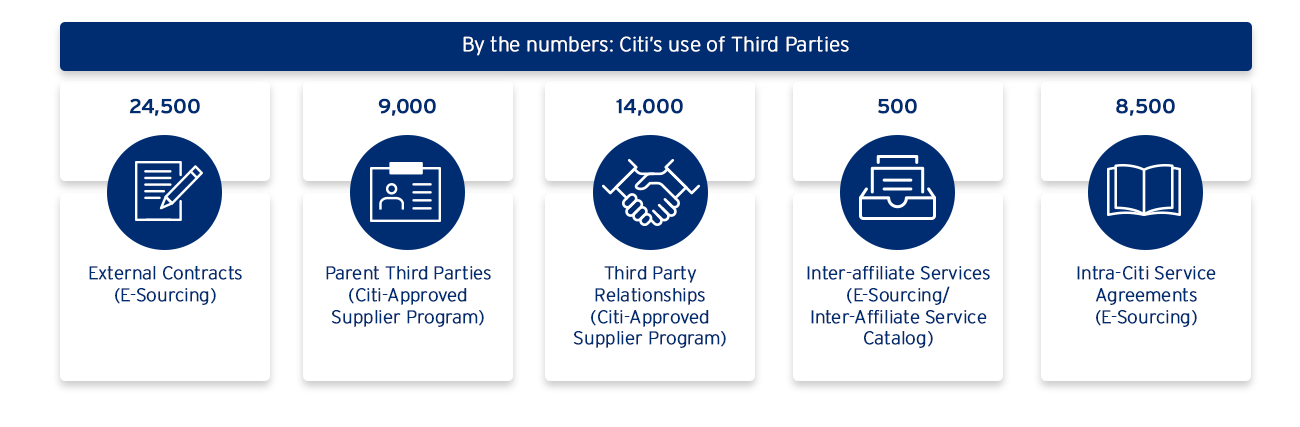

By the numbers: Citi’s use of Third Parties

24,500 External Contracts (E-Sourcing)

9,000 Parent Third Parties (Citi-Approved Supplier Program)

14,000 Third Party Relationships (Citi-Approved Supplier Program)

500 Inter-affiliate Services (E-Sourcing/Inter-Affiliate Service Catalog)

8,500 Intra-Citi Service Agreements (E-Sourcing)

That’s right.

All of these are functions of the TPCRG.

Not quite.

All of these are functions of the TPCRG.

Not quite.

All of these are functions of the TPCRG.

Not quite. Please try again.

Consider that TPCRG is a centralized Global Independent Risk function covering Citi-wide in-scope External Third Party relationships.

That’s right.

All of these are examples of how TPCR is identified.

Not quite.

All of these are examples of how TPCR is identified.

Not quite.

All of these are examples of how TPCR is identified.

Not quite. Please try again.

You have missed some options. Review and try again.

That’s right.

TPCRG acts as a Second Line of Defense.

Not quite.

TPCRG acts as a Second Line of Defense.

Not quite.

TPCRG acts as a Second Line of Defense.

Not quite. Please try again.

The TPCRG supports Third Party Risk Management, but is not a business owner.

The TPCRG administers the TPCR process for all Citi businesses and sectors.

TPCR exposure arises when there is an agreement with an External Third Party to either hold, settle, prepay or collect Citi funds, where some form of a guarantee or commitment is given to Citi by an external third party, or a liability to Citi exists as a result of an external third party relationship.

The first step of the TPCR process is Identification. In this step, TPCR is identified as in-scope and financial statements are collected for in-scope suppliers.

Select each tab to learn about remaining steps in the Third Party Credit Risk process.

TPCRG may collaborate with stakeholders to quantify TPCR exposure.

Risk Officer prepares Credit Approval Memorandum (CA).

Based on this analysis an approval decision is provided. If Third Party Credit Risk Group objects, the supplier cannot be engaged for this relationship.

CA is approved in the amount known as the TPCR Management Action Trigger (MAT), per the approval grid in the Wholesale Credit Risk Due Diligence and Rules Governing Extension of Credit Standard, “Grid 2.1”.

The decision is communicated to stakeholders and reflected in the Due Diligence Scorecard or Ongoing Monitoring Tool, as appropriate.

TPCR MAT is reported in Citi Risk Systems.

That’s right.

All of the responses are common elements of TPCRG’s analysis. Other common elements are: Exit Strategy Plan Review and Financial Review.

Not quite.

All of the responses are common elements of TPCRG’s analysis. Other common elements are: Exit Strategy Plan Review and Financial Review.

Not quite.

All of the responses are common elements of TPCRG’s analysis. Other common elements are: Exit Strategy Plan Review and Financial Review.

Not quite. Please try again.

It looks like you missed some common elements. Review the choices and try again.

Failing to manage the risks of External Third Party relationships can result in negative outcomes for Citi’s business, operations, and reputation.

Failing to manage the risks of External Third Party relationships can result in negative outcomes for Citi’s business, operations, and reputation.

Failing to manage the risks of External Third Party relationships can result in negative outcomes for Citi’s business, operations, and reputation.

That is correct.

That is not correct.

That is not correct.

The term Risk Accountable is used for any roles and responsibilities that generate risk regardless of which line of defense they reside in.

The term Risk Accountable is used for any roles and responsibilities that generate risk regardless of which line of defense they reside in.

The term Risk Accountable is used for any roles and responsibilities that generate risk regardless of which line of defense they reside in.

That is correct.

That is not correct.

That is not correct.

A supplier misappropriating pension funds is an example of reputation risk. The other situations are examples of Third Party Credit Risk.

A supplier misappropriating pension funds is an example of reputation risk. The other situations are examples of Third Party Credit Risk.

A supplier misappropriating pension funds is an example of reputation risk. The other situations are examples of Third Party Credit Risk.

That is correct.

That is not correct.

That is not correct.

Products/services that require any of these items will trigger Third Party Credit Risk.

Products/services that require any of these items will trigger Third Party Credit Risk.

Products/services that require any of these items will trigger Third Party Credit Risk.

That is correct.

That is not correct.

That is not correct.

Business Activity Owner (BAO) and Third Party Officer (TPO) are roles that perform a risk-generating activity and are therefore designated as risk accountable.

Business Activity Owner (BAO) and Third Party Officer (TPO) are roles that perform a risk-generating activity and are therefore designated as risk accountable.

Business Activity Owner (BAO) and Third Party Officer (TPO) are roles that perform a risk-generating activity and are therefore designated as risk accountable.

That is correct.

That is not correct.

That is not correct.

The Second Line of Defense is comprised of independent risk management units, which include TPCRG, and is responsible for overseeing the risk taking activities of the First Line of Defense and challenging the First Line of Defense in their execution of risk management responsibilities.

The Second Line of Defense is comprised of independent risk management units, which include TPCRG, and is responsible for overseeing the risk taking activities of the First Line of Defense and challenging the First Line of Defense in their execution of risk management responsibilities.

The Second Line of Defense is comprised of independent risk management units, which include TPCRG, and is responsible for overseeing the risk taking activities of the First Line of Defense and challenging the First Line of Defense in their execution of risk management responsibilities.

That is correct.

That is not correct.

That is not correct.

TPU performs the initial financial analysis of third parties. TPCRG reviews/challenges/provides objection or no objection of the financial analysis and approves Third Party Credit Risk (TPCR), if TPCR is present.

TPU performs the initial financial analysis of third parties. TPCRG reviews/challenges/provides objection or no objection of the financial analysis and approves Third Party Credit Risk (TPCR), if TPCR is present.

TPU performs the initial financial analysis of third parties. TPCRG reviews/challenges/provides objection or no objection of the financial analysis and approves Third Party Credit Risk (TPCR), if TPCR is present.

That is correct.

That is not correct.

That is not correct.

Prepayment is Citi’s advanced payment for a service that hasn’t been performed, where payment frequency/installments are semi-annually or longer, and with the amount of greater than $1MM USD.

Prepayment is Citi’s advanced payment for a service that hasn’t been performed, where payment frequency/installments are semi-annually or longer, and with the amount of greater than $1MM USD.

Prepayment is Citi’s advanced payment for a service that hasn’t been performed, where payment frequency/installments are semi-annually or longer, and with the amount of greater than $1MM USD.

That is correct.

That is not correct.

That is not correct.

The financial risk rating is one of the factors considered in determining the third party’s Financial Capacity to Perform. Financial Risk Ratings are internal and are not to be shared with third parties.

The financial risk rating is one of the factors considered in determining the third party’s Financial Capacity to Perform. Financial Risk Ratings are internal and are not to be shared with third parties.

The financial risk rating is one of the factors considered in determining the third party’s Financial Capacity to Perform. Financial Risk Ratings are internal and are not to be shared with third parties.

That is correct.

That is not correct.

That is not correct.

An affirmative answer to any of these questions indicates the presence of TPCR.

An affirmative answer to any of these questions indicates the presence of TPCR.

An affirmative answer to any of these questions indicates the presence of TPCR.

That is correct.

That is not correct.

That is not correct.